Tough Times at Tudor Hedge Fund

August 17th, 2016 5:29 amVia Bloomberg:

-

Firm informed employees on Tuesday about the job reductions

-

Tudor has suffered $2.1 billion in redemptions this year

Billionaire Paul Tudor Jones dismissed about 15 percent of the workforce in a shakeup at his hedge fund that’s reeling from more than $2 billion in investor withdrawals this year.

Tudor Investment Corp., which oversees $11 billion and employs about 400 people, earlier Tuesday informed the affected employees, which include positions ranging from money managers to support staff, three people with knowledge of the matter said. The firm got redemption notices for $400 million this quarter, according to another person, after being hit with $1.7 billion in withdrawals in the first half.

The cuts at Tudor, one of the oldest and most expensive hedge funds, shows the upheaval in the industry is engulfing even the most renowned firms, as large investors sour on the high-fee managers. Tudor, founded in 1980, trimmed fees this year after lackluster returns, while some long-time money managers have left. Jones has in the past year accelerated a revamp of the firm using quantitative tools.

“Amid a changing operating environment, we have made strategic adjustments to our firm’s staffing,” Tudor said in a statement, which didn’t specify how many jobs are being cut. “These difficult changes were made after conducting a deep and broad review of our business and are meant to optimally size the firm for future success. We are committed to treating our departing employees with care and support and appreciate their many contributions to Tudor.”

Trailing Markets

The current job cuts are focused on money managers that had posted losses or failed to post profits, said the people who asked not to be identified because the firm is private. Tudor, which is based in Greenwich, Connecticut, and has offices in cities including Singapore and London, is reducing headcount globally, they said. The firm employed 409 people, about half in investing roles, according to the latest regulatory filing.

Tudor has hired scientists and mathematicians, some with doctorates, to help money managers with trading. Jones has told colleagues that his firm needs to get up to speed with newer technologies as quant funds post robust profits, the people said.

Tudor this month hired Amit Tanna, a macro money manager, and quant trader Lykomidis Mastroleon, who has a PhD in electrical engineering, both from BlueCrest Capital Management, one of the people said. In June, Tudor hired Brad Davis, a money manager who focuses on financial stocks, from Balyasny Asset Management, and Jonathan Kommemi, a quant trader and former instructor at Princeton University, the person said.

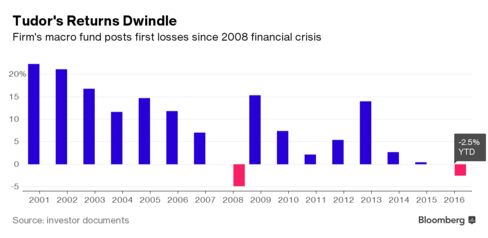

Jones, 61, helped spawn a generation of macro traders who bet on everything from currencies to commodities. Like other firms, Tudor has struggled to outperform markets since the 2008 financial crisis. Its main fund lost 2.5 percent this year through Aug. 5, according to an investor.

No Standouts

A fund that is based on the performance of multiple teams of managers, Tudor Discretionary Macro, has lost 2.8 percent this year. That fund was started in 2012 to help with succession planning for Jones. It has yet to yield a standout manager.

Tudor isn’t the only macro hedge fund suffering. Last year, Brevan Howard Asset Management cut 50 jobs, mainly support roles, amid shrinking assets and losses. The reduction represented more than 10 percent of the 435 employees the firm employed as of June last year. The firm’s main fund fell 2.25 percent this year through July, extending two years of declines.

Some U.S. endowments and foundations are reducing their investments in hedge funds, following similar moves by retirement plans and insurance companies.

The average hedge fund posted a 1.2 percent gain this year through July, while macro funds rose less than 0.1 percent, according to data compiled by Bloomberg. The S&P 500 Index returned 7.7 percent in the period.