September 5th, 2016 7:25 am

Via Marc Chandler at Brown Brothers Harriman:

Drivers for the Week Ahead

The last two weeks have been about the US. First, it was Jackson Hole. The leadership of the Federal Reserve, Yellen, Dudley, and Fischer sang from the same songbook. They all signaled that the time was approaching to take another step in the normalization of monetary policy, without specifying precisely when. Then it was the US employment report, which Fischer had specifically identified as important.

After the July employment data in early August, the US 2-year yield was at 72.2 bp. It finished last week at 78.6 bp. It was down six basis points on the week, with the decline mostly the result of the disappointing manufacturing ISM earlier in the week. The yield closed fractionally higher after the August employment report before the week the weekend.

The September Fed funds futures implied a yield of 41 bp after the July jobs data, and after everything was said and done, it implied a 41.5 bp at the end of last week. The net change after the August jobs report was a quarter of a basis point or the spread between the bid and offer. By our calculation, the implied 41.5 bp yield is the same as a 22% chance of a rate hike later this month. Bloomberg’s WIRP, which has become a widely cited benchmark, puts the odds at 32%.

The CME, where the Fed funds futures trade, offers its calculation here. Its estimate is close to ours, and it puts the odds of a rate hike at 21%. Reasonable people may have different ideas on where Fed funds will average after the hike. They have been averaging 40 bp since late-June, but before then, they often were below the midpoint of the 25-50 bp range. We made the unbiased assumption that Fed funds would average the midpoint of the new 50-75 bp range or 62.5 bp.

The US economy is poised to snap a three-quarter period of sub-2% growth. The NY Fed’s GDP tracker was flat at 2.8%. The Atlanta Fed’s tracker is at 3.5%, little changed from its first estimate for Q3 on August 3 of 3.6%. It was taken down to 3.2% after the construction spending and manufacturing ISM, but marked higher after the trade figures before the weekend that pointed to a smaller drag from net exports.

The most important takeaway is that the composition of growth is changing this quarter. Consumption will pullback after its second strongest quarter since the crisis. It looks as if government and investment will improve over the second quarter. The wild card is inventories. It is difficult to have much confidence with the limited data that is currently available, but it looks like the inventory headwind may still be there, even if diminished.

Four central banks from high income countries meet this week: The Reserve Bank of Australia, the Bank of Canada, Sweden’s Riksbank, and the European Central Bank. The first three will likely come and go with little fanfare.

It is well known that the RBA would prefer a weaker currency, but it not prepared to do much about it. Even at a record low, the cash rate remains well above other countries’ equivalent. It is Stevens last meeting before his deputy Lowe succeeds him. The Bank of Canada cannot be happy with the 1.6% annualized contraction in Q2, but it will look past the short-run disruptions. June growth exceeded expectations.

With a minus 50 bp repo rate and a minus 1.25% deposit rate, and a bond buying program, Sweden’s Riksbank, the oldest central bank in the world, should be counted as among the most aggressive of central banks presently. Its economy grew 3.1% year-over-year in Q2. Deflation has ended, and the CPI is rising gradually. It enjoys a large current account surplus. There is no pressure for fresh action.

That leaves the ECB. The meeting is significant. Staff forecasts will be updated. Two things are patently clear. The economy does not have much forward momentum. Price pressures remain disappointingly subdued. Also, it is safe to assume that despite Draghi’s pleas, the reform drive has stalled, or worse. Nor is there much prospect for fiscal stimulus. Yes, the tragic earthquake in Italy could see a bit more spending, and while it may be significant for the rebuilding efforts, it is unlikely to be on a sufficient scale. It is small enough for to meet Brussels’ muster, it probably will not do much on the national level, let alone the region.

It comes down to Germany, and it is a question of politics; of will, not means. Given the decline of Merkel’s popularity, one might tempted to give credence to speculation that she is considering offering a tax cut. In some other countries, maybe, but seems unlikely in a country where there is one word for both guilt and debt. Moreover, maybe it misreads German politics. Merkel faces two challenges, and both are to her right.

The most important is with the Bavarian CSU. The strain between the two began over Merkel’s acceptance of making efforts to keep Greece in EMU. There were some domestic policy differences, like minimum wage, but Merkel’s immigration policy was the poisoned chalice. The CSU may run their own candidate as Chancellor if the egos are strong enough and if there was a reasonable chance of success. The mandatory caveat is that Merkel’s rivals have often underestimated her to their chagrin.

Her other challenge is with the AfD. Although the party has been wracked by internal discord and fissures, the AfD, has struck a responsive chord with its anti-immigration rhetoric. Through a leadership change, it has morphed from an anti-EMU party to anti-immigrant. It is likely to be an important force in next year’s national elections. It is possible that the AfD edges past the CDU in the weekend’s Mecklenburg-Vorpommern state election, but in national polls, its support is around 12%.

Merkel tacks to the right with a greater emphasis on law-and-order issues, but this does not seem sufficient to solidify her right flank. These domestic challenges suggest that Merkel will have to take a hardline on European issues over the next year.

So, we return to the ECB. Over the last few months, the TLTRO II and corporate bond purchase programs have been implemented, but it is too early to evaluate the results. There does not seem to be a consensus to do more, and, perhaps, the most that can be reasonably expected is to extend the asset purchase program beyond of March 2017. That is probably the path of least resistance, and if not now, when? Given the ECB’s modus operandi, the next window of opportunity would be with updated staff forecasts in December.

If the ECB does not announce an extension of its QE, many market participants are likely to be disappointed. They could express the disappointment by selling bonds, and possibly other risk assets. However, Draghi could mitigate the backing up of rates by implying that procedurally, the formal decision would be made later, but there was a consensus of dissatisfaction.

However, the decision to extend the purchases is more complicated that it may appear. An extension of the program will require a secondary and tertiary decision about the pending shorting, primarily in Germany but experienced on the margins by several other sovereigns as well. There are several self-imposed rules that could be altered. The one that has captured the most imaginations is the abandonment of the capital key. The capital key, in effect, means that ECB buys more bonds are larger countries than smaller countries.

There could be other decision-making rules. The fanciful one is that rather than buy bonds proportionate to GDP, the ECB could buy bonds proportionate to the size the debt market. This would favor, for example, Italy over Germany. It would solve the shortage challenge but spur other issues. The capital key is an important decision-making principle and many countries,

There are other ways to address the shortage issue. The most straightforward is to remove the interest rate floor on purchased securities. Currently, the floor is the deposit rate, minus 40 bp. There is not a necessary link between the yield the ECB receives for overnight deposits and what the yield it pays when it buys a negative yielding bond. In these operations it is not borrowing short and lending long, which would make in fact link the two rates.

There appears to be little appetite to lower the deposit rate further, perhaps in general, but it particularly now. And it could not be counted on as a reliable way to address the scarcity issue, as yields can be driven lower still. It could become a little like the dog chasing its tail. The yields fall below the ECB’s floor. The floor is lower. Yields fall further. So far, in this experiment, that is what has happened. Lather, rinse and repeat.

Some have suggested raising the cap or issuer limit from the current 33%. While this is a bit arbitrary (what is the difference between say 33% and 45%?), there is an underlying money and risk management issue. The point is that neither lifting the issuer limit or cutting the deposit rate deeper into negative territory have limited potential to be scaled.

The Bank of England does not meet this week, but the MPC will meet the following week on September 15. The recent string of data suggests that the Brexit decision was a shock to the economy. The July data, like the industrial output, manufacturing production and construction that will be reported this week will reflect that shock.

However, the news has been superseded. The August manufacturing and construction PMIs that were reported last week were better than expected. The combination of no immediate policy changes, including triggering Article 50 and the divorce proceedings, and the decline in sterling and the fall in interest rates may be underpinning British resiliency. Because of the structure of the UK economy, and especially the high proportion of household debt (mortgages) are at variable rates, the fall in rates can be passed through relatively quickly. It has a one-off impact, as does the decline in sterling.

The August service PMI will be reported on Monday (while the US markets will be closed for Labor Day). The depreciation of sterling will have less impact on the service sector. Although the service sector is the largest part of the UK economy, we suspect that it has to be a significant disappointment to boost expectations for a rate cut at the MPC meeting in the middle of the month.

If PM May is not going to trigger Article 50 until next early next year, at the soonest, and the BOE is on the sideline, then there is no reason why the Brexit decision needs to be the dominant driver of sterling over the next, say, couple of months. That said, May indicated that the government will outline is broad plans for the post-exit relationship with the EU. Brexit Minister Davis will present this to parliament. It may ease speculation in some quarters that due to the complexity of the issue, or the second thoughts by some, the Brexit was not really going to happen.

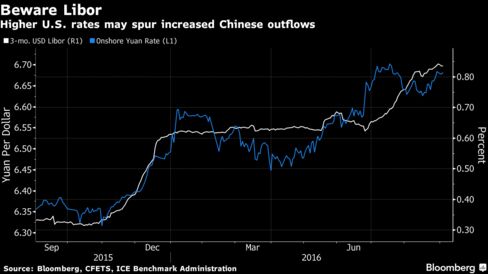

If the yen’s strength is the most counter-intuitive development this year, then the market’s insensitivity to Chinese developments may be among the most welcome developments. The moves that were so disruptive in August 2015 and January this year have continued, but global markets have become decoupled. Recent data have suggested the economy is stabilizing, and the capital outflows have slowed.

There are two reports in the coming days that could have impact outside of China. The first is the inflation measures. Deflation in producer prices is slowing, and the CPI appears stable. The year-over-year rate has averaged 1.9% in the May through July period, the same as over the past 12 months. The fall in grain prices warns of the risk of easier price pressures. While easing of price pressures may give the PBOC scope to ease monetary policy, officials seem in no hurry to do so.

The other report that may impact investors is China’s trade balance. China is the largest trading partner for many countries in Asia. Its demand for many commodities is understood to impact prices. China’s trade surplus appears to have begun growing again. It has averaged $45.9 bln through July, according to Chinese figures, which is nearly three billion more than the average during the first seven months last year. The August surplus is expected to be near $58.3. It would be the second consecutive month above $50 bln, for the first time since December 2015 and January 2016.

The US trade figures for July were largely overshadowed by the employment data except for economists trying to estimate Q3 GDP. However, there was one nugget that is suggestive of coming trade tensions between the US and China. In July, the US recorded an overall deficit of $39.5 bln. The US-China deficit was $30.3 bln. We suspect that regardless of the outcome of the US election, among the most important economic issues is how China’s surplus capacity will be absorbed. To the extent that China tries to export it, the more intense the clash. The excess capacity in the steel industry was highlighted in the draft of the G20 statement.

Posted in Uncategorized | Comments Off on More FX