October 3rd, 2016 6:35 am

Via Marc Chandler at Brown Brothers Harriman:

Drivers for the Week Ahead

- The start of this week will likely be driven by Deutsche Bank’s travails and dollar funding pressures, which may or may not be related

- At the end of the week, the US reports September employment data

- The leading poll analysts all recognize that the week after the first debate was a difficult one for Trump

- UK Prime Minister May has confirmed earlier suggestions that she will trigger Article 50 at the end of Q1 17

- Italian Prime Minister Renzi has backtracked from the resignation talk

- There are still political risks aplenty in EM, as evidenced by the Hungarian and Colombian referendums over the weekend

The dollar is mostly softer against the majors. The Scandies and the Loonie are outperforming while sterling and Kiwi are underperforming. EM currencies are mostly firmer. ZAR, RUB, and MXN are outperforming while TRY and RON are underperforming. MSCI Asia Pacific was up 0.7%, as the Nikkei rose 0.9%. MSCI EM is up 0.8%, as Chinese markets are closed for a week-long holiday. Euro Stoxx 600 is up 0.2% near midday, while S&P futures are pointing to a lower open. The 10-year UST yield is up 1 bp at 1.60%. Commodity prices are mostly higher, with oil up 1%, copper up 0.1%, and gold up 0.2%.

The start of this week will likely be driven by Deutsche Bank’s travails and dollar funding pressures, which may or may not be related. The end of the week features the US monthly jobs report. Despite being a noisy, high frequency time series subject to significant revisions, this report (like none other) can drive expectations of Fed policy.

Deutsche Bank is faced with two challenges: its business and several outstanding legal cases. It is well appreciated that the European bank business model has broken down, even as the low and now negative interest rate environment is exacerbating the problems. An important distinction, however, is that while European banking problems (as in Greece, Italy, Portugal, and Spain) are often made acute by their nonperforming loans, this is not Deutsche Bank’s issue. Only a quarter of its assets are tied to loans, according to reports.

The bank had what accountants euphemistically call negative revenue last year, which means it lost money (~7.7 bln euros or ~$8.6 bln). There is a 35 bln euro (~$39.4 bln) gap between the market value of the bank and the bank’s value of its tangible assets. The bank failed to pass two consecutive stress tests conducted by the Federal Reserve. Earlier this year, the IMF identified the bank as the single largest source of global financial systemic risk.

It is the bank’s legal problems that are the source of the immediate pressure, and roiling the markets. There are three numbers that have caught investors’ attention: 6, 14, and 16. The bank’s litigation reserves are reportedly near 6 bln euros (~$6.75 bln). The Department of Justice has proposed $14 bln fine for fraudulent practices relating to the issuance packaging, securitization, and sales of residential mortgage-backed securities. The market capitalization of the bank is roughly 16 bln euros (~$18 bln).

For the wrongdoing in the residential mortgage space, some banks have been fined more and some less than the Deutsche Bank’s $14 bln fine. Reports suggest that the level of the fine is not simply a function of the damage inflicted, but also the bank’s cooperation. In addition, Deutsche Bank has been involved in several other cases, and according to Bloomberg, has paid more fines than any other bank since 2008.

An unconfirmed report before the weekend, claiming that Deutsche Bank’s fine would be negotiated down to $5.4 bln, saw a dramatic collective sigh of relief. Risk assets, including Deutsche Bank stock, financials, and equity markets, were propelled higher. The dollar reversed earlier gains that had sent the euro to new lows for the week. Investors will be sensitive to whether this report is confirmed.

Investors are particularly concerned about the systemic risks posed by Deutsche Bank. Reports suggest that the gross notional value of its derivatives book is 46 trillion euros. Many have warned of a potential Lehman-like event. Contributing to this sense was a sudden jump in the demand for dollar funding. Since the financial crisis, several central banks have been auctioning dollars, and there is quasi-permanent swap line between the Federal Reserve and five central banks (ECB, BOJ, BOE, BOC, and SNB).

These swap lines remain largely dormant. Last week, the ECB tapped the line for a $29 mln (paying 0.95%). The BOJ took one million dollars. Earlier this year the BOJ had doubled the size of its dollar auctions. Last week, a dozen European banks borrowed $6.35 bln at the ECB’s dollar auction. This is the most in four years. Unconfirmed reports indicated that none of the banks were German.

The implications seem exaggerated by the investors’ sensitivity and the some media accounts. First, the average of dollar borrowing per bank at the ECB has been higher. Even the cumulative amount is not indicative of a crisis. Second, the borrowings cover quarter-end. There was an increase in borrowings and participation in June as well, just on a smaller magnitude.

Third, part of the demand for dollar funding may be a function of the dislocation being caused by the new rules regarding US money markets. The preference for funds that invest solely in government securities appears to have driven up LIBOR yields. In turn, this is exacerbating extreme pricing in the commonly used cross-currency swap market, where the cost of transferring liquidity or hedging euro and yen exposure into dollar has risen dramatically.

The new money market rules come into effect in the middle of October. The risk is that a previous buyer of short-term paper, US money markets, will have a considerably lower appetite. A new source of demand has yet to materialize. This warns that LIBOR rates may stay elevated in both absolute terms and relative to T-bills (TED spread). Traditionally, the TED spread was a function of credit risk as T-bills have the backing of the US government while Eurodollars bear the credit risk of the depository institution.

At the end of the week, the US reports September employment data. Although non-farm payrolls are difficult to forecast, we note that four pieces of data point to a strong report. Weekly jobless claims have fallen since August. The BLS data found about 50k more people than average missed work in August due to the weather. Most of these should be expected to have returned. A job availability measure, embedded in a recent consumer confidence report, rose to its best level since 2008. Reports indicate that the withholding tax (from paychecks) rose 6% in September.

Not only is there scope for an upside surprise to the median market guesstimate of 170k, but other details of the report are expected to be constructive, including average hours worked and hourly earnings. Although pricing of the Fed funds futures strip continue discounts about a 50% (50.6%, according to Bloomberg) of a hike this year, we think the bar to a December hike is relatively low, and the jobs report will more than meet it.

If the market is under-pricing the risk of a December hike, it appears to be exaggerating the likelihood of a November move. Bloomberg’s calculation estimates that market pricing is consistent with a 17.1% chance of a hike next month. The CME’s calculation puts its 10.3%, while our own calculation puts it at 7.5%. However, that is just the math. Away from the abstract computation, we want to say that there is no chance of a hike a week before the US election. There is simply no precedent for it, and that urgency is not such that it would demand a violation of this precedent.

Claims that the Federal Reserve has not raised rates this year (yet) based on some political calculus is wide of the mark, even though we thought a hike could have been prudently and cautiously delivered already this year. Our error lay not with under-appreciation of political leverage, but rather in not sufficiently recognizing the extent of the inventory-investment cycle (slower cyclical growth) and difficulty in getting the domestic economy and global developments to be aligned.

Growth is accelerating here in Q3 and broadening. It will still snap the string at three consecutive quarters of less than 2% growth. The Atlanta Fed GDP tracker says 2.4% growth, while the NY Fed’s tracker puts it at 2.2%. Consumption rose 4.3% in Q2. Last week’s data confirm a slowing to around 2.7%, according to the Atlanta Fed, which matches the past four quarter average. Despite the talk of insufficient aggregate demand, US consumption, which is a little more than 2/3 of the economy, is not the problem. Inventories will be less of a drag, and net exports may contribute positively to GDP.

Speculation that a Trump victory in November would lead to Yellen’s resignation at the Federal Reserve is also likely wide of the mark. The commitment to the independence of the central bank requires that she remain chair until her term is expires on 1 February 2018. It is the will of Congress that the Chair’s term does not exactly coincide with a presidential term.

That said, the leading poll analysts all recognize that the week after the first debate was a difficult one for Trump. The odds widened back out, with some swing states moving back to the Clinton camp. This week features the debate among vice presidential candidates. It is not expected to draw nearly the audience of the presidential debate.

UK Prime Minister May has confirmed earlier suggestions that she will trigger Article 50 to formally begin its divorce proceedings from the EU at the end of Q1 17. Several officials have already hinted this time frame, though many have been skeptical that Article 50 would be triggered at all, given the complexities of the issues.

We had warned back in the summer about the political risks posed by the Italian constitutional referendum and Renzi’s indication that he would resign if the referendum does not pass. Many observers have recently been highlighting these risks. However, since we first wrote about it, the situation has evolved, but it does not seem that many recognize the change.

Specifically, and most important, Renzi has backtracked from the resignation talk. First, he has acknowledged it was a mistake to link the two in the first place. It allowed his critics to make it into a referendum about him. It also unnecessarily jeopardized this government. Second, he has indicated that no matter what the outcome of the December referendum, parliamentary elections will take place as scheduled in 2018.

He is saying one plus one. The only logical conclusion is two. So why doesn’t Renzi just say if the referendum does not pass he will not tender his resignation? Perhaps he has been advised not to talk about defeat in any way. Interior Minister Alfano, who hails from a small center-right party, was quoted over the weekend confirming that regardless of the referendum results, the government will continue. Renzi has taken his campaign to the grassroots, and despite the opposition parties united against the referendum, he is hold his own. Most polls appear within the margin of error, with a large number of undecided voters.

The opposition cannot force him to resign. He could be toppled within the PD, just as he took down Letta, but this does not appear in the works. However, there is a price to be paid for not explicitly saying he will not resign. That price is the underperformance of Italian assets.

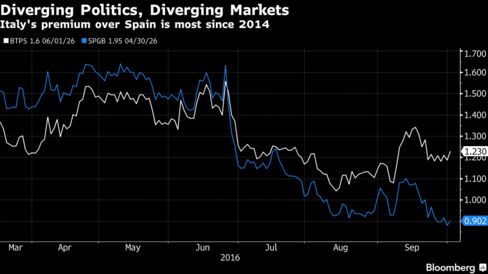

Italian stocks and bonds performed worse than Spain in Q3. Italy’s 10-year benchmark yield eased 4 bp in Q3. Spain’s fell by 27 bp. Through the first three quarters, Italian’s yield has fallen 40 bp, while Spain’s has dropped almost 89 bp. In Q3 Italy’s stocks rose 0.6% to trim the 2016 loss to 23.4%. Over the last three months, Spanish equities rose 6.2% to nearly cut the year’s loss in half (-8%). With the Spanish Socialist Party seemingly imploding, the nine-month political stalemate will likely be resolved in the coming weeks with another government led by Rajoy.

Italian assets often trade in line with risk assets. We see a window of vulnerability toward the end of this month. DBRS is the only one of the top four rating agencies that recognizes Portugal as an investment grade credit. It will review its assessment on October 21, a week after Lisbon is to submit new fiscal plans to the EC. DBRS It has recently expressed concerns about the poor growth and fiscal plans.

If DBRS cuts Portugal’s rating, and not just its outlook, the country’s bonds will no longer qualify as collateral for ECB borrowings (without an explicit exemption) or for purchases under the ECB’s asset purchase program. Portuguese bond yields have backed up more than 30 bp in Q3 and 80 bp for the year. Pressure from Portugal could weigh on Italian assets, but between the DBRS decision and the referendum in early December, a low-risk opportunity to buy Italian assets may present itself.

EM ended the week on a firmer note, and that firmness is carrying over to this week. Yet there are still political risks aplenty, as evidenced by the Hungarian and Colombian referendums over the weekend. In Hungary, 98% voted to reject EU immigration quota, but turnout of 43% fell short of the 50% needed to make the vote valid. In Colombia, voters narrowly rejected a referendum on the recent peace deal with FARC. Both outcomes inject more uncertainty into already difficult situations.

China is closed all week on holiday. It reported its official PMI over the weekend, as the manufacturing PMI remained steady at 50.4, near a two-year high. The non-manufacturing PMI rose to 53.7 from 53.5. Many EM countries will report September CPI data, with most likely to show accelerating inflation. This is similar to what we’re seeing in DM as well. The Indian and Polish central banks meet, with neither expected to change policy. We think EM will be driven in large part by political developments.

Posted in Uncategorized | Comments Off on FX