FX

October 27th, 2016 6:23 amVia Marc Chandler at Brown Brothers Harriman:

Rising Yields Remain the Main Driver

- The driving force in FX markets is the continued climb in interest rates

- While the ECB is widely expected to announce its changes at the December meeting, the BOJ’s Kuroda all but said not to expect any action next week

- The UK reported stronger than expected Q3 GDP

- Sweden and Norway central banks held policy meetings, and both kept policy on hold

- The US reports September durable goods orders, but the focus is on tomorrow’s first look at Q3 GDP

- Turkey’s central bank released its quarterly inflation report

The dollar is mixed against the majors. The Norwegian krone and the Swiss franc are outperforming, while the Swedish krona and the Aussie are underperforming. EM currencies are mostly weaker. The CEE currencies are outperforming while TRY, KRW, and MXN are underperforming. MSCI Asia Pacific was down 0.7%, as the Nikkei fell 0.3%. MSCI EM is down 0.6%, with Chinese markets falling 0.3%. Euro Stoxx 600 is down 0.2% near midday, while S&P futures are pointing to a lower open. The 10-year UST yield is up 4 bp at 1.83%. Commodity prices are mostly higher, with Brent oil up 0.7%, copper up 0.2%, and gold up 0.2%.

The euro remains pinned near the seven-month low it recorded two days ago near $1.0850. It approached $1.0950 yesterday and has been confined to about a 15-tick range on either side of $1.0905 today. Against the yen, the dollar remains near the three-month high (~JPY104.85) also seen two days ago. New dollar buying emerged yesterday near JPY104.

The driving force is the continued climb in interest rates. The US 10-year yield pushing through 1.80% and is at its highest level since early June. It has moved above its 200-day moving average (~1.72%) recently for the first time since the very start of the year.

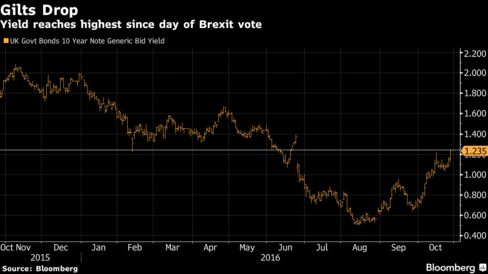

The rise in yields is not just a US phenomenon. The 10-year German bund yield closed above its 200-day moving average (8 bp) yesterday for the first time this year, and it is up another handful of basis points today. The 0.14% yield is the highest in four months. Today may be the first day since early-January that the yield on the UK’s 10-year gilt will close above its 200-day moving average (1.16%). The 10-year JGB yield has been flirting with its 200-day moving average (-6.5 bp) since early-September. Here, yields are broadly steady between minus 10 bp and zero.

Despite the backing up of rates, the market remains convinced that the ECB will extend its asset purchases. Most of the increased price pressures in the eurozone likely reflect the recovery in oil prices. The flattish core rate below 1% reflects this. In addition, the recovery in lending seems to stall at a subdued pace. Lending to non-financial companies grew 1.9% year-over-year in September, unchanged from August. Similarly, lending to households remained stuck at 1.8%. M3 growth itself slowed to 5.0% from 5.1%

While the ECB is widely expected to announce its changes at the December meeting, the BOJ’s Kuroda all but said not to expect any action next week. Kuroda indicated that it might not need to buy JPY80 trillion a year to keep the 10-year bond yield near the zero target. Separately, local press reports continue to play up the likelihood that the BOJ pushes out when its inflation target will be reached again to FY2018. It seems that rather than a date-specific guidance, the BOJ (and investors) would be better served by keeping it vague like the US “medium term” or the UK’s rolling two-year framework. The ECB talks about achieving its target as quickly as possible. The BOJ keeps finding itself in a position whereby to maintain its credibility, it is stretching it needlessly.

The widespread criticism that the easy monetary policy and negative interest rates asphyxiate banks may be a bit exaggerated. At least four large banks reported earnings today (Deutsche Bank, Barclays, Nomura, and BBVA) and they all did better than expected. Deutsche Bank, for example, surprised markets by reporting a profit in Q3. One thing that they had in common was that trading profits had been an important contributor. The reports, however, were not sufficient to prevent heavier stock prices.

The Dow Jones Stoxx 600 is off about 0.3% near midday in London, while the financials are off 0.2%. Deutsche Bank shares are off 0.5% at pixel time and have been alternating advances and declines since last Thursday. If the pattern holds, this will be the fifth week that the beleaguered bank shares have risen. Italian bank shares are slightly higher. They have been moving up only one exception since October 13.

The UK reported stronger than expected Q3 GDP. The preliminary estimate is that the economy expanded by 0.5%. Many had expected a 0.3-0.4% pace after a 0.7% Q2 expansion. The strength of services seems to have more than offset the other drags. Sterling continues to trade in the consolidative range that has confined prices since the flash crash.

Sweden and Norway central banks held policy-making meetings, and both kept policy on hold. Sweden’s Riksbank kept expectations further easing next year very much alive. Norway’s Norges Bank left rates on hold for the fourth meeting and judged that the economy had evolved along its expectations. Norway’s krone is the strongest of the majors today, with a 0.5% rise against the dollar. The Swedish krona is the weakest of the majors today, and it has fallen about 0.5%.

The dollar-bloc currencies are under pressure after poor price action in North America yesterday. The US dollar closed at new session highs against the Canadian dollar. The US dollar is near 7-month highs against the Loonie. The Australian dollar was again turned back from the $0.7700 area. It appears to be in a one cent range on either side of $0.7600. Initial support is now just below there at $0.7580.

The US reports September durable goods orders, but the focus is on tomorrow’s first look at Q3 GDP. Weekly initial jobless claims may get a passing look, but next week is the national report, and a modest slowing of jobs growth is anticipated. An increase in pending home sales, which would be only the second improvement since April, bodes well for later in Q4 and early Q1 17. Lastly, the KC Fed manufacturing activity index jumped to 6 in September from -4 in August. It was the second increase since February 2015. A pullback but a still positive reading is expected in October.

Turkey’s central bank released its quarterly inflation report. It kept its 2016 inflation forecast steady at 7.5% but raised the 2017 forecast from 6.0% to 6.5%. The bank expressed concern about the inflation pass-through of a weak lira, noting that this had an impact on the decision to keep rates steady this month. CPI rose 7.3% y/y in September, and remains above the 3-7% target range. With lira weakness continuing, the bank may leave rates steady again at the next meeting November 24. Interestingly, Erdogan and other government officials have for the most part refrained from jawboning the bank in recent months.